Does TurboTax import from Coinbase?Īt this time, TurboTax allows users to import transactions from Coinbase through Form 1099-B. If you have more than a handful of cryptocurrency transactions, trying to report your crypto transactions directly within TurboTax alone can get complicated.

However, TurboTax’s cryptocurrency functionality is limited. TurboTax does allow users to report cryptocurrency on their taxes. Can I file cryptocurrency taxes on TurboTax? Examples of earning cryptocurrency income include earning staking income or airdrop rewards.įor a more detailed explanation, check out our complete guide to cryptocurrency taxes.

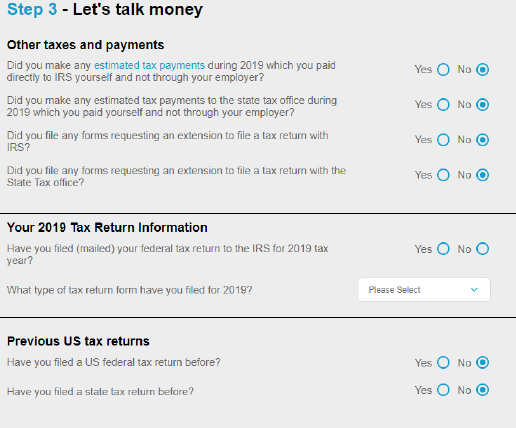

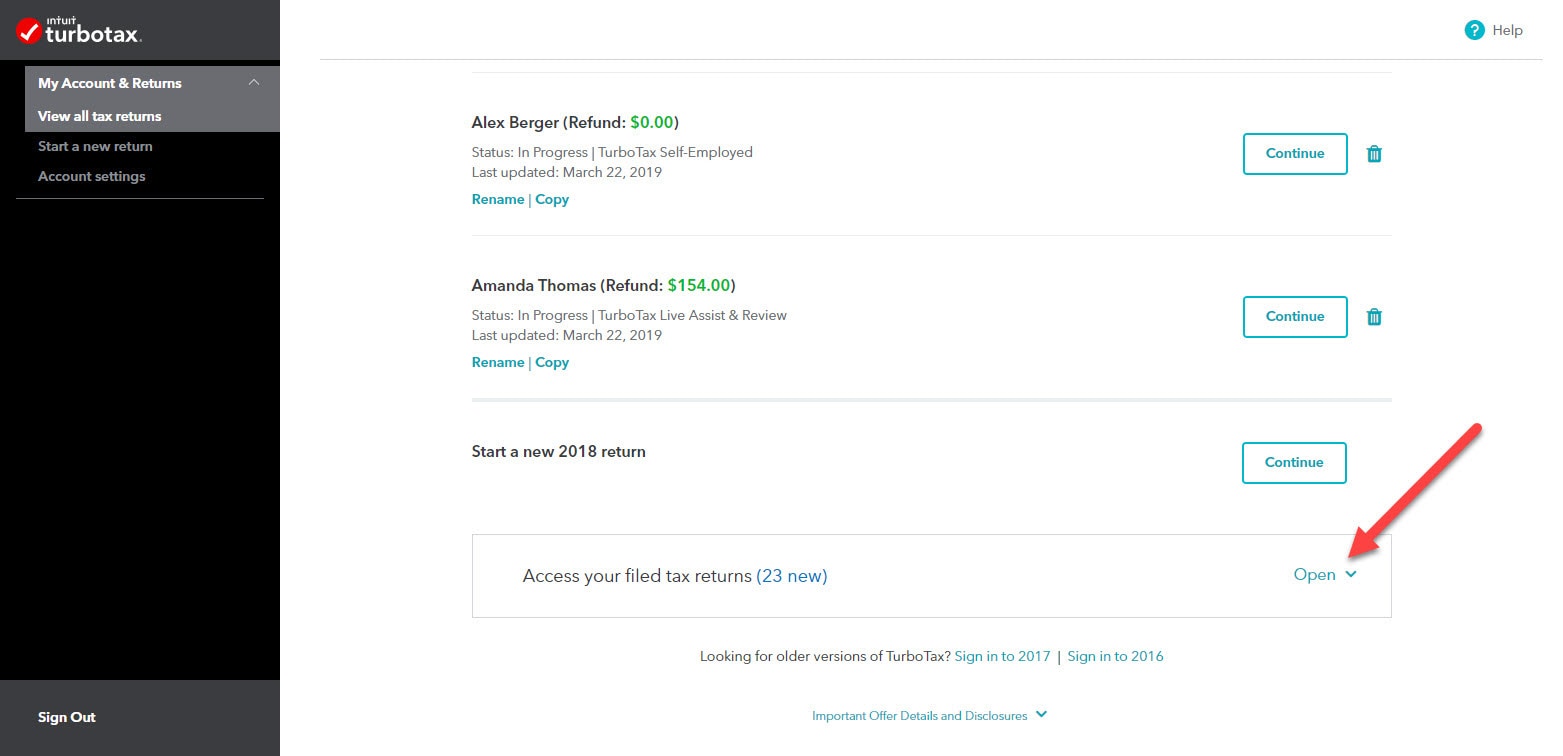

Ordinary Income: If you earn cryptocurrency directly, you’ll recognize ordinary income based on the fair market value of your coins at the time you received them. Examples of cryptocurrency disposals include selling your cryptocurrency or trading your coins for another cryptocurrency. Remember, cryptocurrency is considered a form of property subject to capital gains and income tax.Ĭapital gains: If you dispose of your cryptocurrency, you incur a capital gain or loss. The basics of cryptocurrency taxesīefore we dive into how you can report your cryptocurrency trades on TurboTax, let’s review the basics of crypto taxation. In this guide, we break down the basics of cryptocurrency taxes and walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTax-both online and desktop versions. To enable this functionality, the TurboTax team has partnered with CryptoTrader.Tax. TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app.

0 kommentar(er)

0 kommentar(er)